OUR PROGRAMES

TRAINING PROGRAMME LIST

BANDS – CODE GUIDE:

1. Awareness & Information Course

2.1 Trade Finance Operations & Practices

2.2 Trade Financing Instruments

2.3 Trade Finance Competencies Programmes

3. Legal Aspect Courses & Case Studies Workshops

4. Specialist Courses

5. Skill-Based Programmes

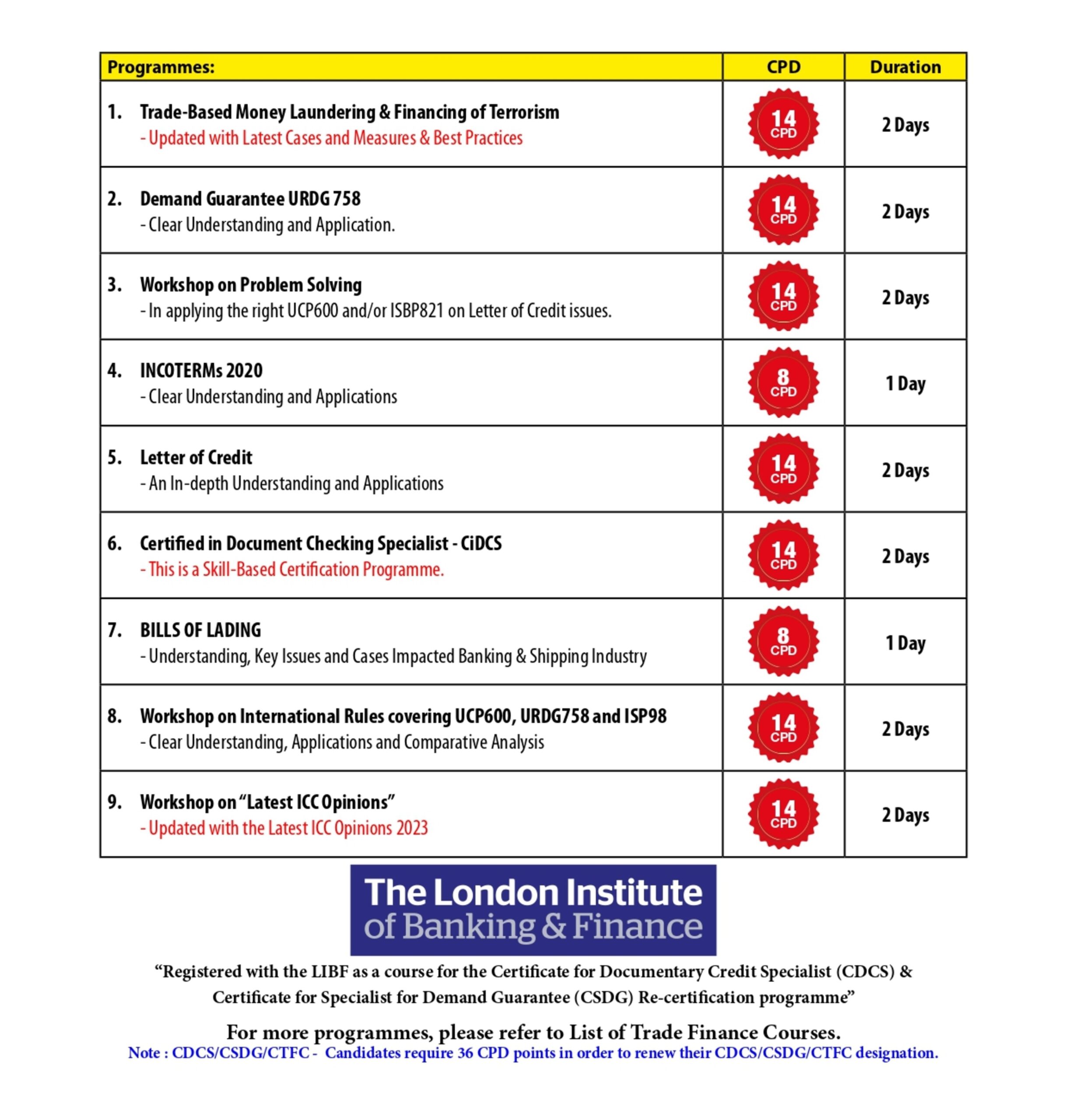

Recertification Programmes for CDCS, CSDG and CTFC Holders

We provide professional development activities via training programmes which are eligible for CPD (Continuing Professional Development) towards the CDCS, CSDG and CTFC recertification programmes.

For more information, please email us at mdimran@tradequest.com.my or call +6 016-7533763.

Tradequest’s CDCS, CSDG, CTFC programmes are accredited by

The London Institute of Banking & Finance for CPD purposes.

Awareness & Information Course

TFC100

Introduction to International Trade Finance

TFC101

Introduction to Documentary Credit Mechanism

TFC102

Introduction to Documentary Collection Mechanism

TFC103

Introduction to Incoterm 2020

TFC104

Introduction to Trade Documents

TFC105

Introduction to UCP 600

TFC106

Introduction to ISBP 821

TFC107

Introduction to URC 522

TFC108

Introduction to URR 725

TFC109

Introduction to URDG 758

TFC110

Introduction to various Trade Products and Services available in International Trade

TFC111

Introduction to ISP98

TFC112

Introduction to Bank Payment Obligation – URBPO

TFC113

Introduction to URF 800

Trade Finance Operations & Practices

TFC200

Documentary Credit – Establishment & Amendment

TFC201

Letter of Credit

TFC202

Inward Bills Under DC, TR & SG

TFC203

– ILC, OBC, FBEP(A/P)

TFC204

– Do’s and Don’ts in Collection

TFC211

Correspondent Banking

TFC212

SWIFT Update & Best Practices

TFC213

Applications of UCP 600 & ISBP 821 articles

in LC Operations.

TFC214

in LC Operations.

Trade Financing Instruments

TFC205

Bankers Acceptance

TFC206

Export Credit Refinancing (ECR)

TFC207

On Shore Foreign Currency Loan (OFCL)

TFC208

Foreign Currency Account (FCA)

TFC209

Bank Guarantee (BG)

TFC210

Invoice Financing Vs. Receivable Services

Trade Finance Competencies Programmes

TFC215

– In-depth Understanding and Applications

TFC216

– Clear Understanding and Applications

TFC217

Document Checking under Letter of Credit. The application of UCP 600 and ISBP 821 for the examination of documents.

TFC218

Bills of Lading – Understanding, Key Issues and Case Impacted Banking & Shipping Industry

TFC219

Malaysia Bank Guarantee – An understanding and how this benefits the customer.

TFC220

The importance use of Trade Finance facilities in order to increase cash flows and improve profitability for Exporters and Importers

TFC221

Effective Selling Skills & Relationship Building for Trade Sales

TFC222

Trade Finance Solutions

TFC223

Structured Trade Finance, Commodity and Warehouse Financing

TFC224 Version 1.0

eURC Version1.0 – Clear Understanding and Applications.

TFC224

– Clear Understanding and Applications.

TFC225

Impact of ISBP 821 on Document Checking Process

TFC226

Uniform Rules for Digital Trade Transaction – Version 1.0

– Clear Understanding and Applications

TFC227

International Standard Demand Guarantee Practice – ISDGP

– Clear Understanding and Applications

TFC228

– Clear Understanding and Applications

Legal Aspect Courses & Case Studies Workshops

TFC300

Legal Issues impacting Documentary Credits

TFC301

– Trade Finance cases around the World

TFC302

Trade Finance Case Studies Workshop on

(UCP 600, ISBP 821, URR 725 & URC 522)

TFC303

– Latest Opinions which include 2022.

TFC304

Workshop on In-depth Study of UCP600

Latest Case Studies

TFC305

Advanced Documentary Credit Workshop

TFC306

Advanced Demand Guarantee Workshop

Problem Solving & Risk Courses and Workshops

TFC401

Risks and Controls for Trade Finance Products

TFC402

Trade Finance Operations

TFC403

Advanced Documentary Credit Operations

TFC404

Special Credits covering Standby LC, Red Clause LC, Back to Back LC, Transferable LC, Green Clause LC –

How and when to use it?

TFC405

Special Focus on Transferable LC – Detail coverage on issuing & transferring Credits.

TFC406

Workshop on Problem Solving in applying the right UCP600 and ISBP 821 on Letter of Credit – Part 1

TFC407

Workshop on Problem Solving in applying the right UCP600 and ISBP 821 on Letter of Credit – Part 2

TFC408

Workshop in handling Documentary Collections Issues.

TFC409

Malaysia Import and Export Procedures impacting Trade Operations

TFC410

Managing Operational Risk in Trade Finance

TFC411

Trade-Based Money Laundering & Counter Financing of Terrorism (TBML&CFT)

Update with Latest Cases and Best Practices.

TFC412

Workshop on International Rules covering UCP600, URDG758 and ISP98

Clear Understanding, Applications and Comparative Analysis.

TFC413

International Trade Finance

Specialist Courses

TFC500

Certificate in International Trade Finance (CITF)

CITF Preparatory Classes.

This is a preparatory programme which cover 6 classes in the duration of 3 months. Objective: To prepare the participants for the CITF

Examination which is available On Demand.

Examination hosted by LIBF – The London Institute of Banking & Finance.

TFC501

Certificate in Documentary Credit Specialist (CDCS)

CDCS Preparatory Classes.

This is a preparatory programme which covers 9 classes in the duration of 3 months. Objective: To prepare the participants for the

CDCS Examination which is available On Demand.

Examination hosted by LIBF – The London Institute of Banking & Finance.

TFC502

Certificate in Demand Guarantee Specialist (CSDG)

CSDG Preparatory Classes.

This is a preparatory programme which covers 6 classes in the duration of 3 months. Objective: To prepare the participants for the

CSDG Examination which is available On Demand.

Examination hosted by LIBF – The London Institute of Banking & Finance.

TFC503

Certificate in Trade Finance Compliance (CTFC)

CTFC Preparatory Classes.

This is a preparatory programme which covers 6 classes in the duration of 3 months. Objective: To prepare the participants for the

CTFC Examination which is available On Demand.

Examination hosted by LIBF – The London Institute of Banking & Finance.

Skill-Based Programmes

TFC600

Certified Trade Finance Specialist (CTFS) – Skill Based Certification comprises:

TFC601

Certified in LC Issuance Specialist – CiLCS

TFC602

Certified in Applying UCP600 & ISBP 821 Specialist – CiAUIS

TFC603

Certified in Document Checking Specialist – CiDCS

TFC604

Certified in Rebuttal Discrepancies Specialist – CiRDS

TFC605

Certified in Documentary Collection Specialist – CiURCS

TFC606

Certified in Demand Guarantee Specialist – CiDGS

CDCS, CSDG & CTFC – Do you require recertification?

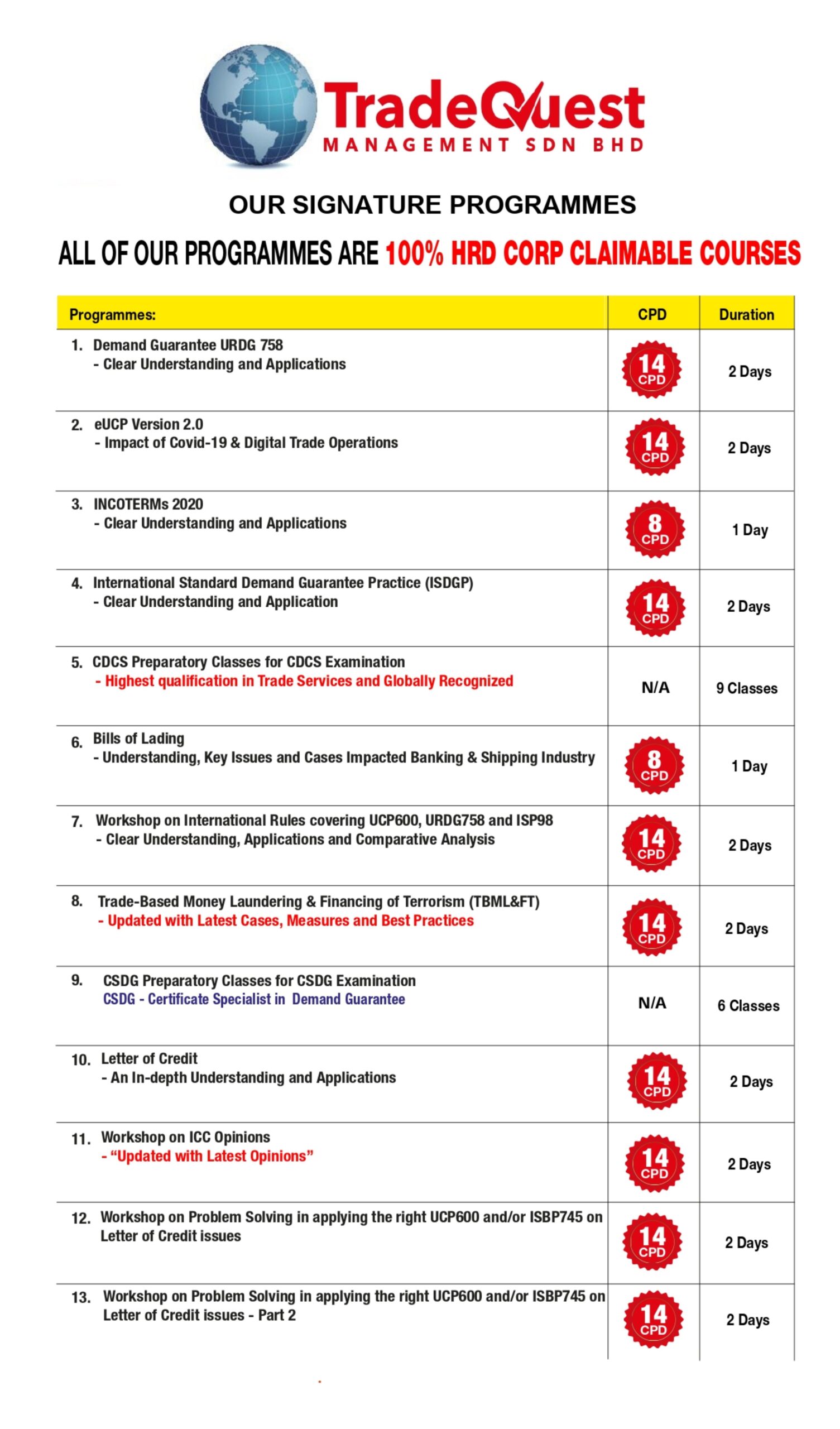

OUR ONLINE AND FACE TO FACE PROGRAMMES

EASIER / COVID-19 COMPLIANCE / COST SAVING / FLEXIBLE TIMING / AWARDED WITH CPD / FUN WITH Q&A

Our Signature Programmes

About Us

TradeQuest specialize in the area of International Trade Finance and with our experience, expertise and certification, we have decided to reach out to all and make the technical training in International Trade Finance as easy as possible.

CDCS and LIBF are (UK) registered trademarks of The London Institute of Banking Finance

Get In Touch

Our Corporate Office:

No. 19A, Jalan Kundang 1,

Taman Bukit Pasir, 83000,

Batu Pahat, Johor , Malaysia

Our Klang Office:

Level 1, No.25, Lorong Hilir 1,

Taman Gembira, 41100 Klang,

Selangor, Malaysia.

+6 016-7533763

+6 07-4338999

+6 07-4332888

mdimran@tradequest.com.my

www.tradequest.com.my