GLOBAL CERTIFICATION

1. CDCS Preparatory Classes

Professional Qualifications

Certificate for Documentary Credit Specialists (CDCS)

Recognised worldwide as a benchmark of competence in documentary credits, CDCS will build your skills and help you advance your trade finance career.

How to pass CDCS Examination?

Why you should take the CDCS Preparatory Classes from TradeQuest?

For detail please click here

We provide the candidates the following benefits:

• Candidates will be given Self Study guideline with time lines.

• Candidate will be guided “what to cover” and “when to complete” each topic.

• Training materials will be given to the candidates especially on those areas need to focus.

• Candidates will be directed to focus on specific areas in order to maximise the passing rate.

• Each chapter assessment as per the CDCS Booklet. (Latest Syllabus as per LIBF).

• Additionally, we provide 24 Hours support via E-mails/Whatsapp/Phone Calls

• 5 Assignments to strengthen UCP600 and ISBP745 applications.

• 3 Mock Examinations to strengthen the candidates abilities.

• Short questions to test the understanding and applications of UCP600, ISBP745, INCOTERMs 2020, eUCP, URR725 & ISP98.

• Assessor feedback from time to time on short questions.

• Sufficient exercises and practices to make the candidate possible to pass the papers.

• Assessor feedback on marked assignments and Mock Examinations.

• 8 Document Checking exercises to strengthen Section B of the examination.

• Analysis on candidates to the HOD on the progress made by the each candidate on bi-weekly basis (for employer – optional).

• Candidates are managed by senior & qualified trainers who are well verse with the CDCS examination requirements.

• Well-structured ONLINE training during the weekends for working candidates.

Note: Our method of delivery, teaching, assessment and experience has secured a passing rate 100%

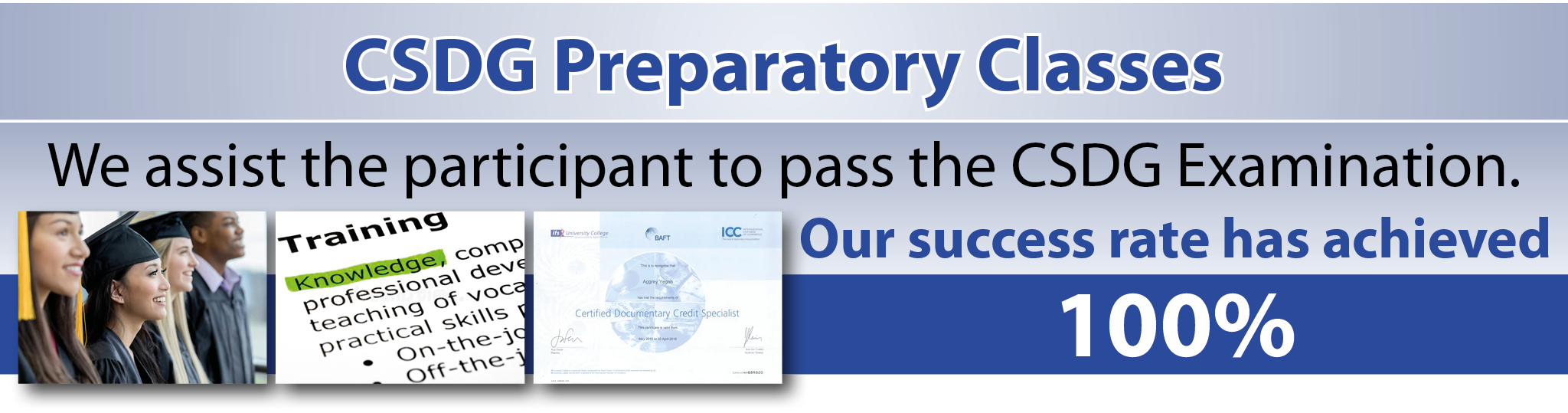

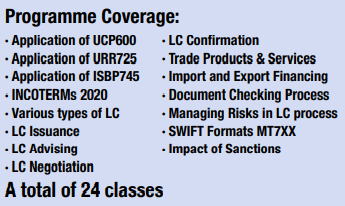

2. CSDG Preparatory Classes

Professional Qualifications

Certificate for Specialists in Demand Guarantees (CSDG)

CSDG develops practical knowledge and expertise in the use of guarantees including industry rules, legislation and the challenges relating to demand guarantees and standby credits.

How to pass CSDG Examination?

Why you should take the CSDG Preparatory Classes from TradeQuest?

For detail please click here

We provide the candidates the following benefits:

• Candidates will be given Self Study guideline with time lines.

• Candidate will be guided “what to cover” and “when to complete” each topic.

• Training materials will be given to the candidates especially on those areas need to focus.

• Candidates will be directed to focus on specific areas in order to maximise the passing rate.

• Each chapter assessment as per the CSDG Booklet (Latest Syllabus as per LIBF).

• Additionally, we provide 24 Hours support via E-mails/Whatsapp/Phone Calls

• 5 Assignments.

• 2 Mock Examinations to strengthen the candidates abilities.

• Short questions to test the understanding and applications of URDG758 and ISP98.

• Assessor feedback from time to time on short questions.

• Sufficient exercises and practices to make the candidate possible to pass the papers.

• Assessor feedback on marked assignments and Mock Examinations.

• 10 Document Checking exercises to strengthen Section B of the examination.

• Analysis on candidates to the HOD on the progress made by the each candidate on bi-weekly basis (for employer – optional).

• Candidates are managed by senior & qualified trainers who are well verse with the CSDG examination requirements.

• Well-structured ONLINE training during the weekends for working candidates.

Note: Our method of delivery, teaching, assessment and experience has secured a passing rate 100%.

3. CITF Preparatory Classes

Professional Qualifications

Certificate in International Trade and Finance (CITF)

CITF will provide you with a detailed understanding of the core areas that underpin international trade, enhance your skillset and build your confidence

How to pass CITF Examination?

Why you should take the CITF Preparatory Classes from TradeQuest?

For detail please click here

We provide the candidates the following benefits:

• Candidates will be given Self Study guideline with time lines.

• Candidate will be guided “what to cover” and “when to complete” each topic.

• Training materials will be given to the candidates especially on those areas need to focus.

• Candidates will be directed to focus on specific areas in order to maximise the passing rate.

• Each chapter assessment as per the CITF Booklet. (Latest Syllabus as per LIBF).

• Additionally, we provide 24 Hours support via E mails / Whatsapp / Phone Calls

• 5 Assignments.

• 2 Mock Examinations to strengthen the candidates abilities.

• Short questions to test the understanding and applications on each chapter in CITF.

• Assessor feedback from time to time on short questions.

• Sufficient exercises and practices to make the candidate possible to pass the papers.

• Assessor feedback on marked assignments and Mock Examinations.

• Analysis on candidates to the HOD on the progress made by the each candidate on bi-weekly basis (for employer – optional).

• Candidates are managed by senior & qualified trainers who are well verse with the CITF examination requirements.

• Well-structured ONLINE training during the weekends for working candidates.

Note: Our method of delivery, teaching, assessment and experience has secured a passing rate 100%.

4. CTFC Preparatory Classes

Professional Qualifications

Certificate in Trade Finance Compliance (CTFC)

CTFC is the new industry certification that will give you the knowledge and understanding you need

to prevent trade-based financial crimes across the globe.

How to pass CTFC Examination?

Why you should take the CTFC Preparatory Classes from TradeQuest?

For detail please click here

We provide the candidates the following benefits:

• Candidates will be given Self Study guideline with time lines.

• Candidate will be guided “what to cover” and “when to complete” each topic.

• Training materials will be given to the candidates especially on those areas need to focus.

• Candidates will be directed to focus on specific areas in order to maximise the passing rate.

• Each chapter assessment as per the CTFC Booklet (Latest Syllabus as per LIBF).

• Additionally, we provide 24 Hours support via E mails / Whatsapp / Phone Calls

• 5 Assignments.

• 2 Mock Examinations to strengthen the candidates abilities.

• Short questions to test the understanding and applications on each chapter in CTFC.

• Assessor feedback from time to time on short questions.

• Sufficient exercises and practices to make the candidate possible to pass the papers.

• Assessor feedback on marked assignments and Mock Examinations.

• 5 Document Checking exercises to strengthen Section B of the examination.

• Analysis on candidates to the HOD on the progress made by the each candidate on bi-weekly basis (for employer – optional).

• Candidates are managed by senior & qualified trainers who are well verse with the CTFC examination requirements.

• Well-structured ONLINE training during the weekends for working candidates.

Note: Our method of delivery, teaching, assessment and experience has secured a passing rate 100%.

Professional Programme in International Trade Finance – PPITF

Trade Finance Professional

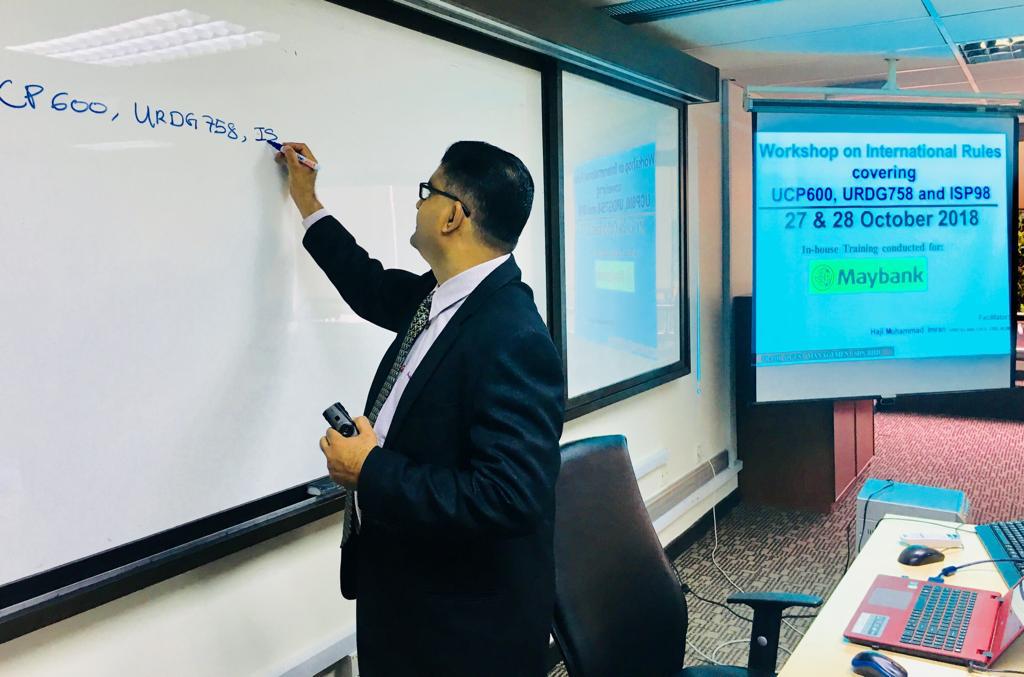

PPITF is designed to help target participants to acquire the knowledge and knowhow in handling trade finance products and services. PPITF is aimed at all professionals who are looking to develop their knowledge of trade finance. The programmes has been designed to provide a comprehensive step-by-step guide in understanding the purpose of International Trade Finance and develop the require skills and knowledge in order to meet the industry requirements.

Studying this programme offers you the knowledge and skills required in handling trade transactions. It will definitely help you to acquire the competencies in International Trade Finance industry. It enable participants to

demonstrate practical knowledge, understanding and skill required in handling trade transactions such as LC Issuance, LC Advising, Document Checking, LC Negotiation, Import and Export Financing, usage of various SWIFT formats, Operational Risks in trade processing and Sanctions.

Ideal for all fresh graduates, junior bankers, retrenched workers, unemployed person and those who wanted to be part of International Trade Finance. PPITF will give you a comprehensive overview of all aspects of trade finance. It is a passport for you to secure employment easily in International Trade Finance.

This is a short term programme with 3 to 4 months duration.

Weekend classes are available to those working adult.

Certified Trade Finance Specialist – CTFS

Trade Finance Professional

About Us

TradeQuest specialize in the area of International Trade Finance and with our experience, expertise and certification, we have decided to reach out to all and make the technical training in International Trade Finance as easy as possible.

CDCS and LIBF are (UK) registered trademarks of The London Institute of Banking Finance

Get In Touch

Our Corporate Office:

No. 19A, Jalan Kundang 1,

Taman Bukit Pasir, 83000,

Batu Pahat, Johor , Malaysia

Our Klang Office:

Level 1, No.25, Lorong Hilir 1,

Taman Gembira, 41100 Klang,

Selangor, Malaysia.

+6 016-7533763

+6 07-4338999

+6 07-4332888

mdimran@tradequest.com.my

www.tradequest.com.my